Enabling and Setting Up the Avalara Tax Plugin

Step 1

Activate the AvaTax plugin.

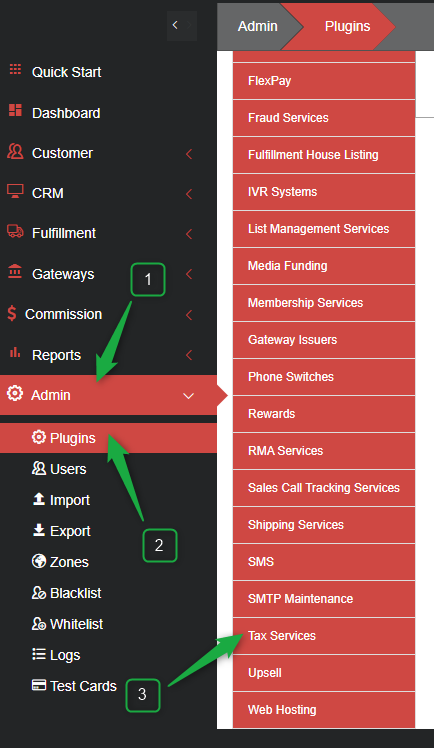

- Click on the Admin section from the navigation sidebar.

- Click on the Plugins page (Admin→Plugins)

- Click on the Tax Services tab.

- Click on the Avalara tile.

- Click + Activate.

Step 2

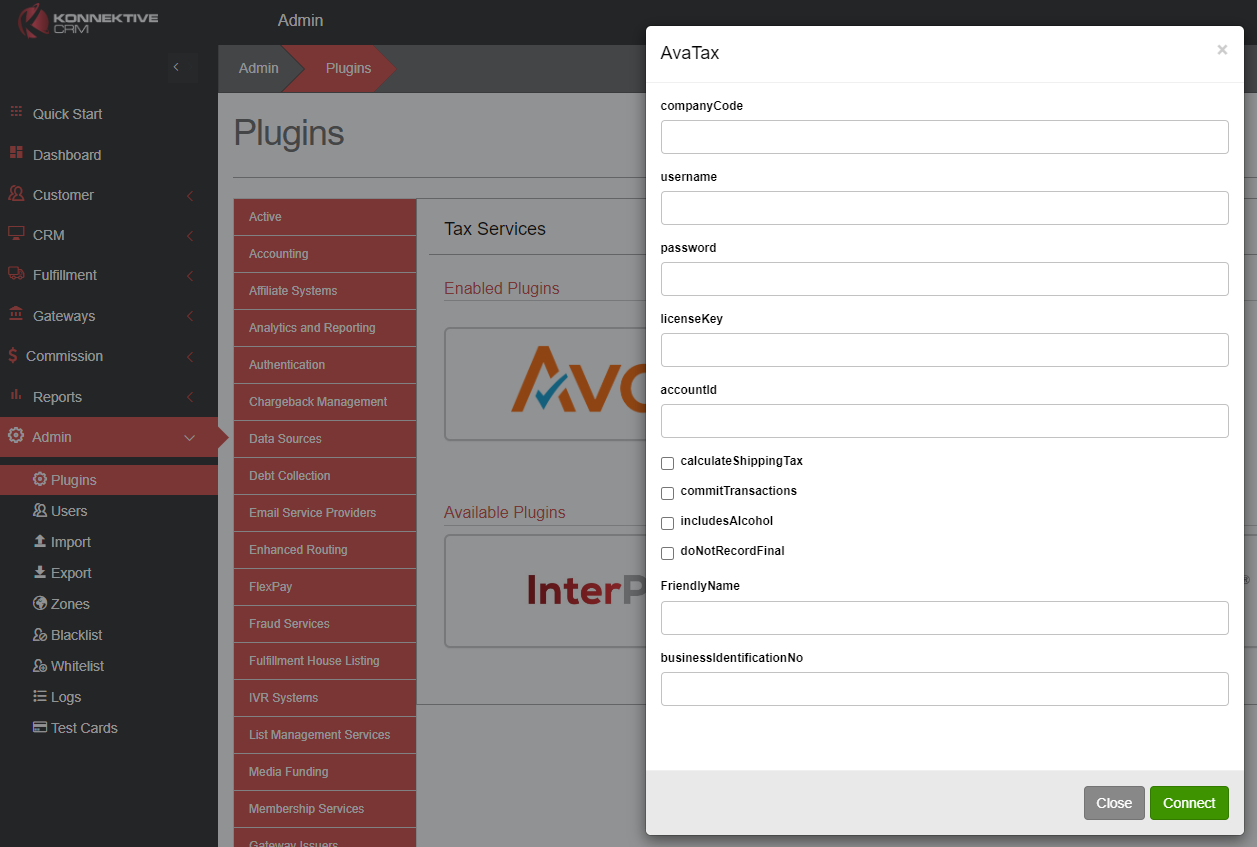

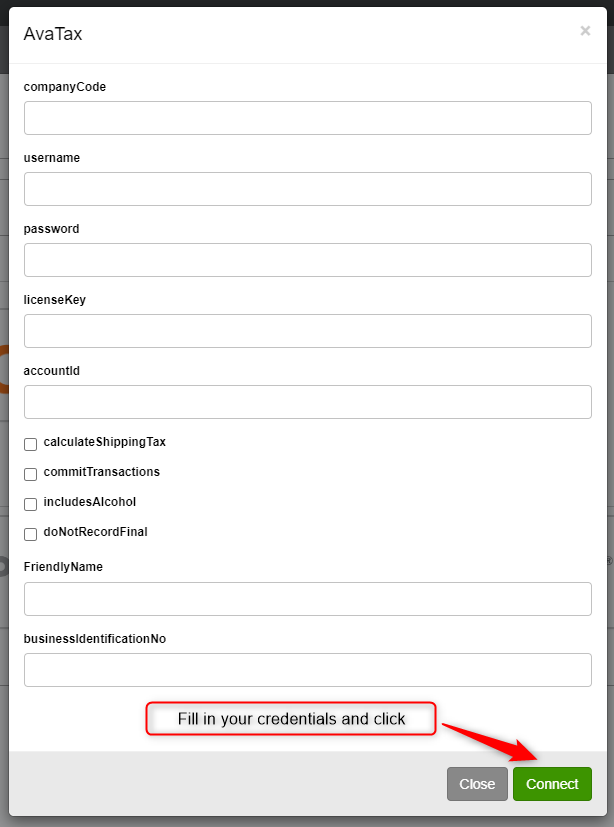

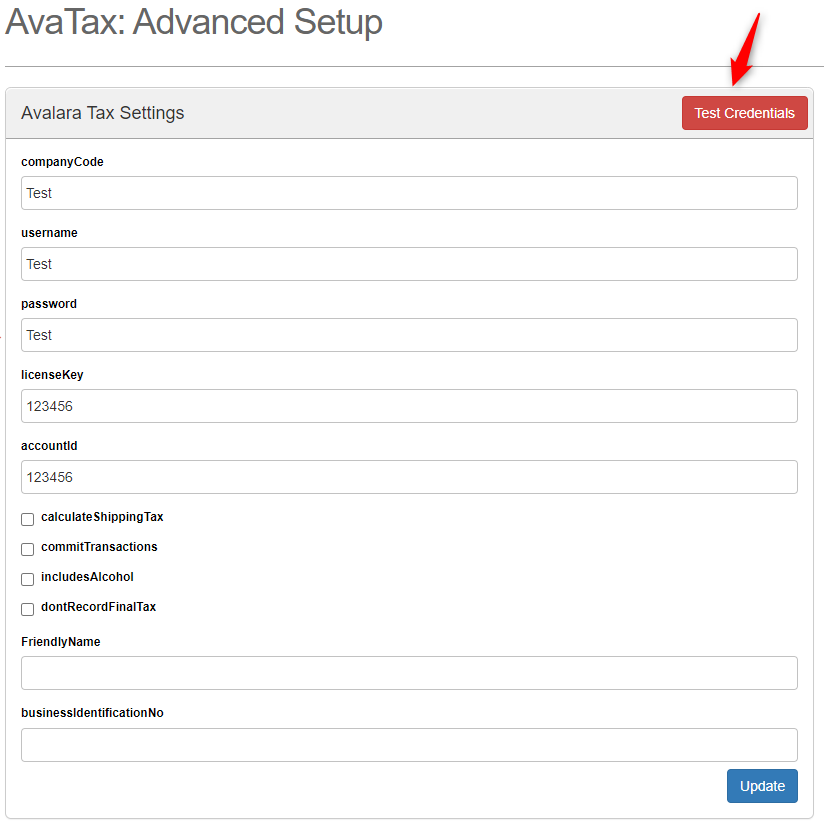

Type in the required fields companyCode, licenseKey, and accountId that you received from Avalara.

Note: Username and Password may not always be required. Attempt an authorization without them then enter those fields if authentication fails.

- Check calculateShippingTax to allow AvaTax to calculate an additional tax on the shipping cost.

Check commitTransactions to cause transactions to be marked as Committed in AvaTax.

- Check includesAlcohol to calculate tax on alcoholic products. Enter the alcohol information on each product in Konnektive.

- Check doNotRecordFinal so transactions will not be committed and will not be marked as type "SalesInvoice". This will continue to return all tax calculations.

- Check sendProductID to send the base product ID as the item code. Leave the box unchecked to send the campaign product ID.

- Enter an optional FriendlyName to differentiate multiple AvaTax plugins

- Enter businessIdentificationNo to calculate taxes outside of USA and Canada. This is required to add other countries to a campaign.

- Check excludeTestCards to not calculate tax on test orders

When finished click on the Connect button.

Note: Committed transactions will show in the reports created by AvaTax and will be included in the tax returns Avalara files for your company.

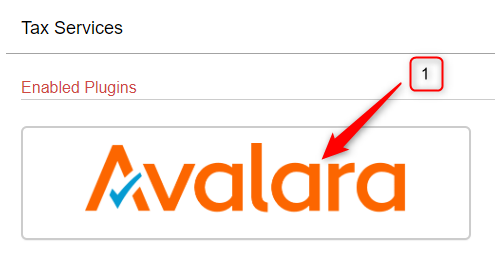

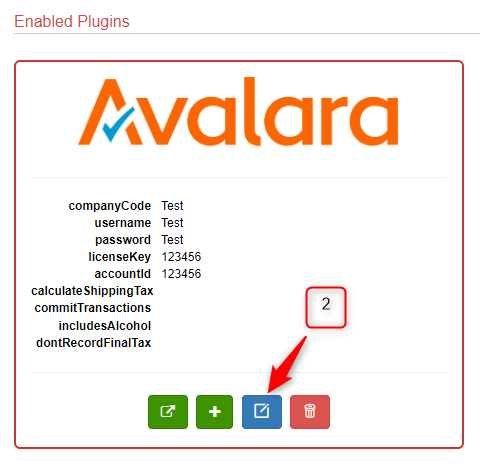

Step 3

Once you have enabled the plugin, click on the AvaTax plugin tile again and then click the blue Edit Icon to open the AvaTax: Advanced Setup page.

Step 4

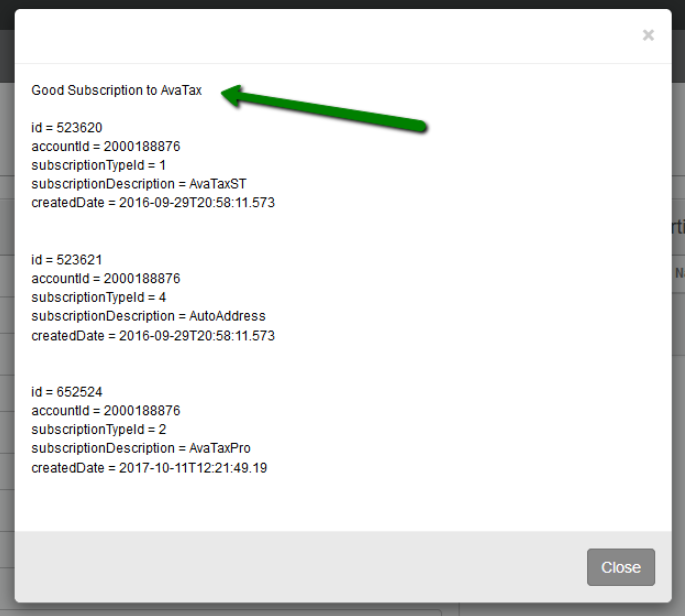

On the AvaTax: Advanced Setup page, click the Test Credentials button to verify your credentials are correct.

A successful test will display your subscription information in a popup.

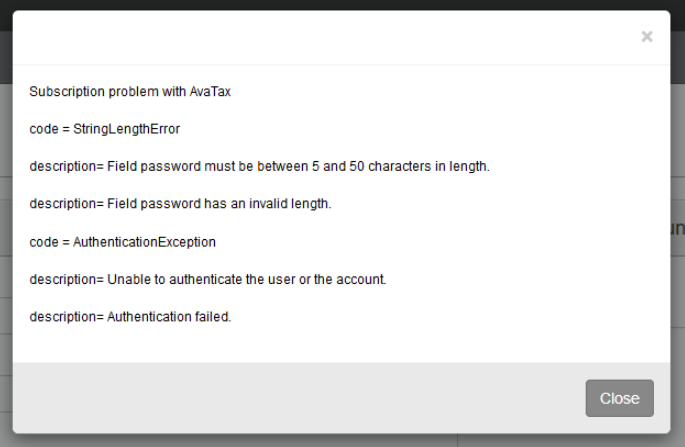

If the credentials are incorrect you will get a pop up box with an error message.

Note: After changing any credentials, you will need to click the blue "Update" button before testing again.

Step 5

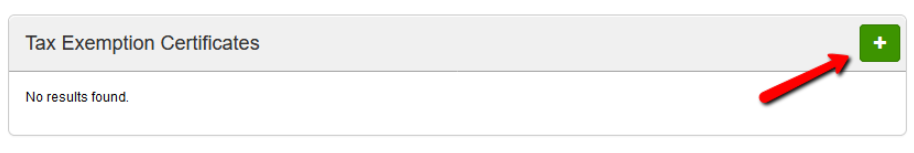

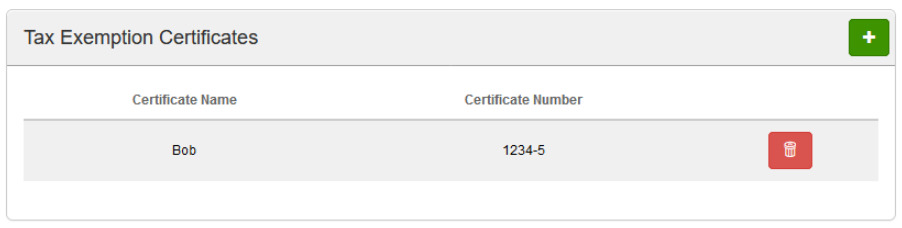

You can also add a new Tax Exemption once you are on the AvaTax: Advanced Setup page by clicking on the green + button under Tax Exemptions Certificates.

Note: Tax Exemption is a monetary exemption which reduces taxable income. Tax exempt status can provide complete relief from taxes, reduced rates, or tax on only a portion of items.

Note: You can add as many Tax Exemptions as you want here.